6 Consequences of a Low Credit Score

Your credit score is a single number that can make or break the quality of your life—from renting an apartment and qualifying for a mortgage to getting approved (or denied) for a new job and finding attractive home and auto insurance rates.

Therefore, it's important to know what factors go into that three-digit number, how you can improve your credit score, and what you can do to protect it.

Leer más

5 Tips To Help You Maintain A Good Credit Score

Your credit report may not seem very important, but in reality, it can impact your finances and even your career prospects. Whether you're applying for a loan or searching for your next job, there are many situations where a positive credit history can help you get ahead of the competition. Adverse credit history can make it challenging to get approved anywhere from renting an apartment to buying your next car or even landing an internship – and the effects can last long after the adverse events. So, how can you keep your credit report up to date??

Leer más

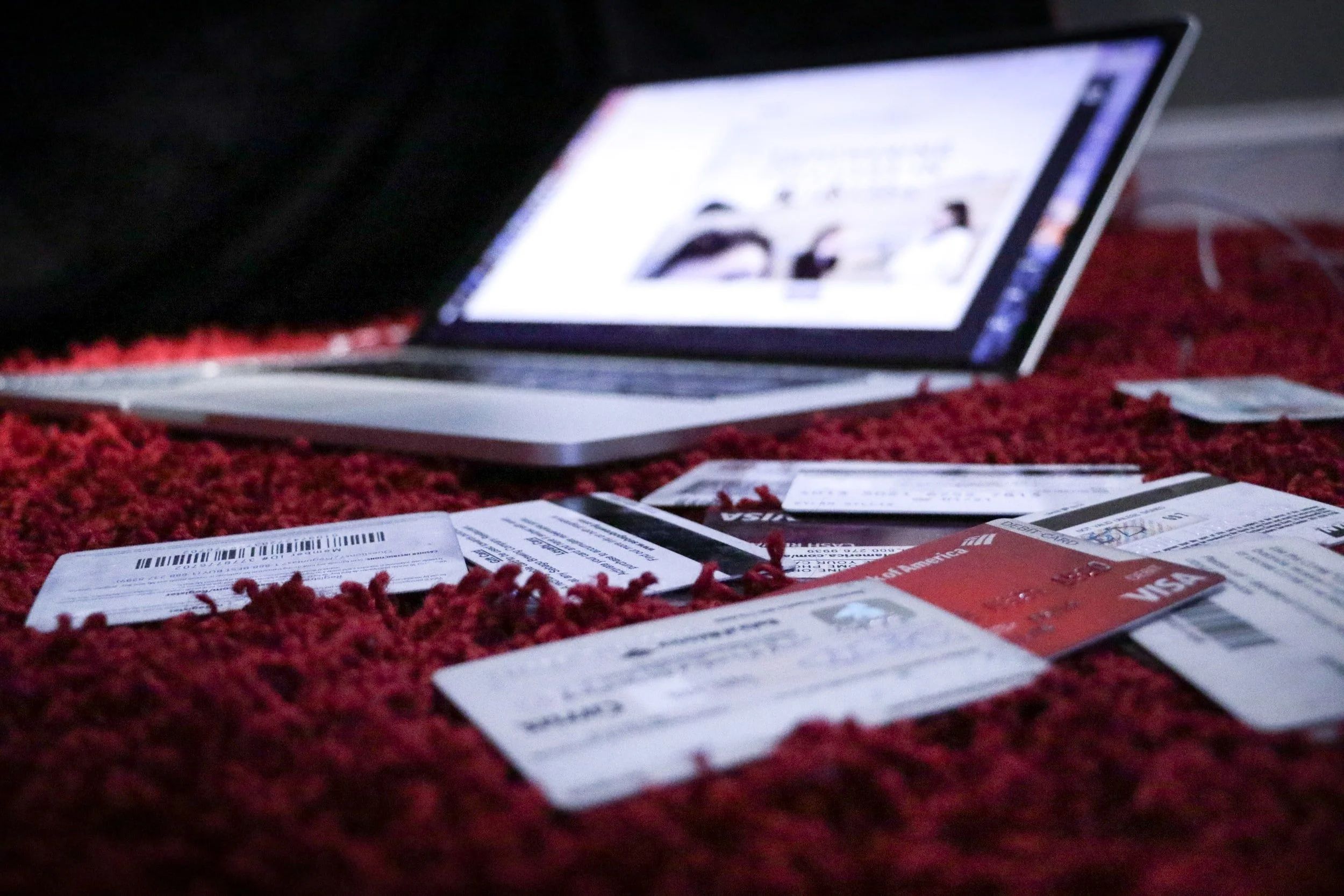

What Do I Do If My Credit Card Is Missing?

You have just got home from a store and when you look in your wallet your credit card is gone. What do you do next?

Leer más

Tips For Building Credit If You Have None

At one time each and every one of us had little to no credit. So if you are in that position now, how can you take steps to build up your credit in a positive way?

Leer más

Should I Pay Off My Car Early?

Paying off an account or getting rid of a bill is an amazing feeling. If you have the cash right now and are looking to get rid of your car payment it may seem like a no-brainer to pay off the loan immediately – but should you?

Leer más

Saving For A Down Payment

Making the decision to purchase a new home is exciting but with that decision comes the financial pressure to save up for a down payment. How can you save more money? How much do you need to put down?

Leer más

How To Keep The Elderly Safe From Financial Scams

Everyone is a target for financial scammers these days but the elderly are especially vulnerable. Scammers often target the least tech savvy and most trusting. With so many lines of communication available, how can you help your elderly relatives stay safe from financial scams?

Leer más

Conserve Energy And Save Money This Winter

Winter is here and so are inflated heating and electrical bills! How can you make some changes to your home to save a little more cash this winter?

Leer más

Tips For Making On-Time Payments

One of the biggest factors in determining your credit score is your payment history. Even one late payment can negatively affect your credit score. So in this busy world how can you make it easier to remember to make your payments on-time?

Leer más

How Do My Student Loans Affect My Credit?

If you have attended college in the past couple of decades chances are you have some kind of student loan debt. Some people walk away with only a few thousand dollars of debt while others graduate with hundreds of thousands of dollars of debt. Regardless of the total amount you owe, how do student loans affect your credit going forward?

Leer más

Do-able Financial Resolutions For 2022

The new year is the perfect time to get your finances on the right track! While you are making your resolutions for 2022 be sure to add in a few that will help you meet your financial goals.

Leer más

What Is An Available Balance?

When you are working on your finances there are a number of terms you will see everywhere. One of these terms is ‘available balance.’

Leer más

What Should I Look For On My Credit Report?

One of the easiest ways to learn about your financial history is to take a look at your credit report.

Leer más

Get Through The Holiday Season Without Going Into Debt

Tis the season for spending! If you have trouble getting through the holiday season without debt you are not alone. This year let’s shop smarter so we can have a great start to the new year.

Leer más

Do I Really Need An Emergency Fund?

Do you have an emergency fund? If not, it's time to get one started! While you are not required to have one, an emergency fund is always a good idea regardless of how well-off you are.

Leer más

How To Avoid Being Scammed This Holiday Season

The season for giving is also the season for scamming. How can you make sure you don’t fall victim to any common scams this holiday season?

Leer más

Read This Before You Purchase A Car

Are you thinking about buying a new car? Like purchasing a house or taking out student loans, purchasing a car is a big life decision that you should not take lightly or rush into. How can you ensure that you will make a smart decision this time around?

Leer más

Considering A Secured Credit Card

If you are looking to either build up good credit or develop better spending habits there are many options out there for you to consider. One of them is a secured credit card.

Leer más

Home Buying 101: ¿Qué es una hipoteca?

Cuando se piensa en comprar una casa, siempre es prudente familiarizarse con lo básico. Una hipoteca es un acuerdo entre el prestamista y el comprador que dice que si los pagos no se hacen, el prestamista tiene derecho a recuperar la propiedad.

Leer más

How Long Does An Eviction Stay On Your Record?

When you are trying to build up your credit you want to try and get rid of any negative marks you may have incurred in the past. One of the things that you may be looking to get rid of is an eviction. How long does an eviction stay on your credit report and is it possible to get rid of them?

Leer más